SMCR Compliance e-Learning courses

Our CPD certified online SMCR e-Learning courses are bespoke to three categories of ‘Solo’ regulated Firms (Limited Scope Firms, Core Firms or Enhanced Firms) and four categories of PRA authorised credit institutions (Banks and Building Societies, Credit Unions, UK Branches of EEA Banks and UK Branches of non-EEA Banks) created by compliance experts at RQC Group. Learners are issued with a CPD certified certificate on successful completion of any of our SMCR e-Learning courses.

SMCR Compliance e-Learning courses

Our CPD certified online SMCR e-Learning courses are bespoke to three categories of ‘Solo’ regulated Firms (Limited Scope Firms, Core Firms or Enhanced Firms) and four categories of PRA authorised credit institutions (Banks and Building Societies, Credit Unions, UK Branches of EEA Banks and UK Branches of non-EEA Banks) created by compliance experts at RQC Group. Learners are issued with a CPD certified certificate on successful completion of any of our SMCR e-Learning courses.

What is SMCR? (Senior Managers & Certification Regime)

SMCR refers to the Senior Managers and Certification Regime, which is a legislation that applies to all FCA-regulated firms in the UK, designed to hold those in senior roles accountable for any regulated activity and decisions.

The FCA’s deadline for solo-regulated firms to be fully SMCR compliant is 31st March 2021.SMCR is applicable to over 60,000 FCA-regulated firms in the UK, including investment managers, product distributors, insurance brokers and consumer credit providers.

The FCA explains that the purpose of SMCR is to ‘reduce harm to consumers and strengthen market integrity by creating a system that enables firms and regulators to hold individual’s to account.’

Hence, all FCA-regulated firms, including banks, building societies and credit unions, must have senior managers with the skills, knowledge and integrity to act in the customer’s best interests.

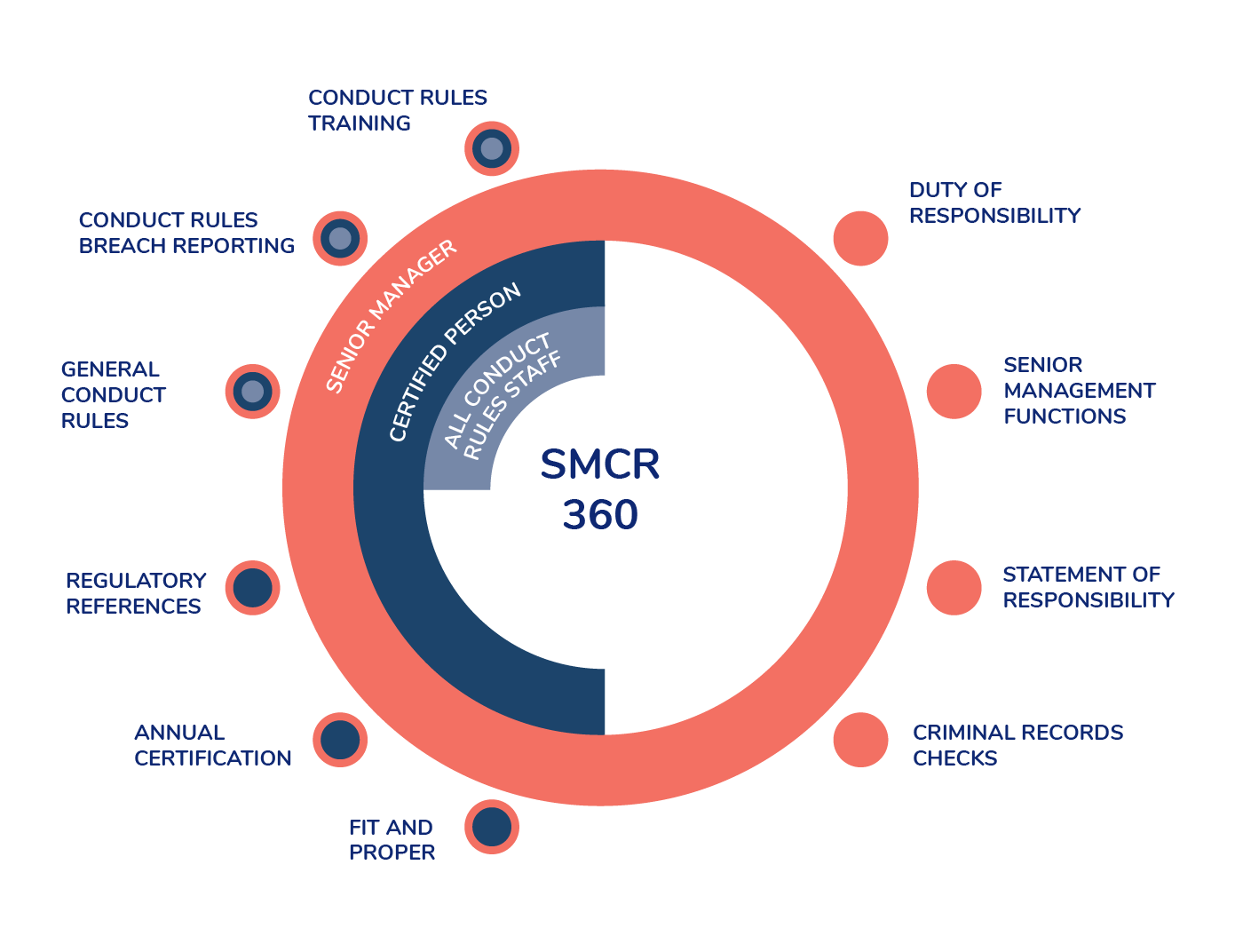

SMCR Compliance offers a full suite of CPD certified online SMCR training courses and toolkits, enabling Senior Managers, Certified Staff and all other staff requiring Conduct Rules training to be fully compliant in line with their firm’s classification.

SMCR solutions tailored to your firm's classification

Our offering is created by compliance experts who advise firms on their regulatory obligations on a daily basis, so we are best placed to understand the regulatory needs of firms and how SMCR impacts them.

We have created our toolkits and CPD certified online training courses to ensure that implementation can be carried out swiftly and effectively, while making sure that it is appropriate depending on a firm's classification.

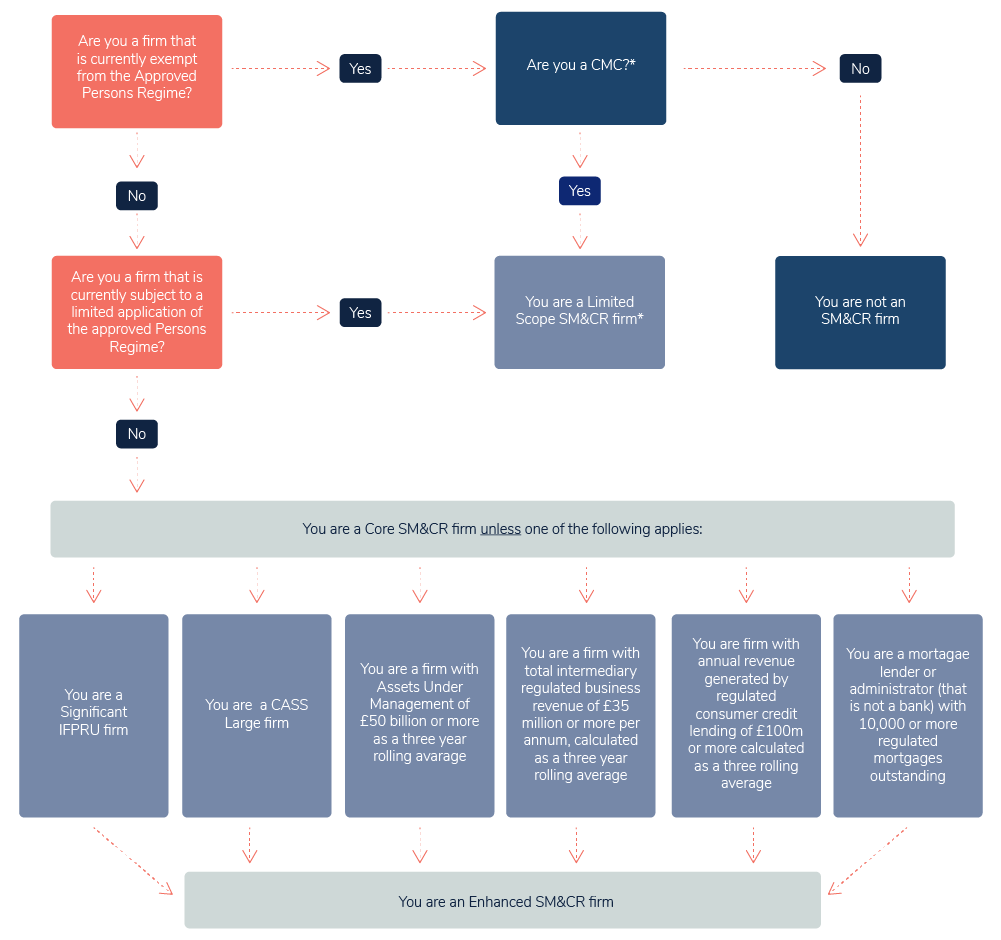

Not sure what firm you are?

If you are unsure what category your firm is please contact us or use our helpful diagram from the FCA

Featured e-Learning courses

SMCR

FAQs

-

What is SMCR?

SMCR – also known as SM&CR - refers to the Senior Managers and Certification Regime.

SMCR represents a significant shift in the way that the UK regulators supervise and monitor the activities of individuals that work in the financial services sector and/or conduct financial services related activities.

In particular, the UK regulators have an ambition to improve ‘cultural behaviour’ at regulated firms and SMCR is a key component in this. SMCR affects almost everyone that works within financial services. -

What are the aims of the senior managers and certification regime SMCR?

The SMCR is part of the UK regulators' drive to improve culture, governance and accountability within financial services firms. It aims to deter misconduct by improving individual accountability and awareness of conduct issues across firms.

-

Who does the SMCR apply to?

SMCR applies to a majority of individuals that work in the UK financial services industry, or work for a firm providing financial services, including some individuals that are based overseas.

-

What does the phrase ‘solo-regulated firm’ mean?

A ‘solo-regulated firm’ is a firm that is authorised and regulated by the Financial Conduct Authority i.e. it only has one UK financial services regulator.

There are almost 60,000 solo-regulated firms, and these are subject to further categorisation. A majority of these fall into three categories reflecting their activities and perceived conduct risk:

Enhanced Firms - Higher risk

Core Firms - Medium risk

Limited Scope Firms - Lower risk

Set out below is some additional guidance on how to work out into which category a solo-regulated firm belongs. -

Why is there a dichotomy between Enhanced Firms and Core Firms on one hand, and Limited Scope Firms on the other?

Limited Scope firms comprise a discrete population of firms i.e. a firm has been identified as Limited Scope by virtue of the activities that it conducts.

For other firm types, the ‘default’ is that the firm is classified as a Core firm. However, certain firms – typically larger firms – will instead fall into the Enhanced category by virtue of various criteria.

Latest news

Keep up to date with the latest regulatory news in the UK and US